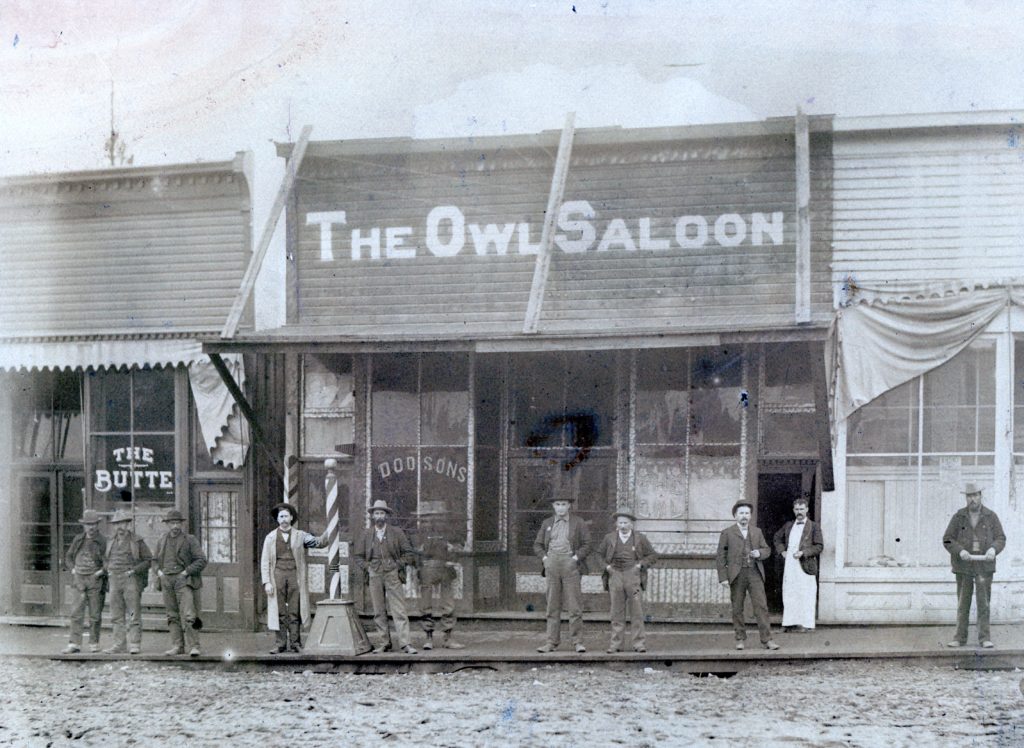

When Susanville was incorporated as a city in 1900, it had one glaring problem—it had no funding mechanism in place. During the debate whether to incorporate, proponents made it clear there would be no property tax. It was their belief that the City could operate on revenues generated from business license fees, especially the lucrative fees set by the state on saloons. Lassen County still collected the liquor license fees on the five saloons in Susanville. The County fathers were not going to give up this money without a fight, and they did.

It was a messy legal battle. It would force the City to impose a property tax assessment until the liquor license issue was resolved. In August 1903, the City imposed a tax levy of 40 cents per $100 assessed value.Of course, there were critics and even talks of disincorporation.

Relief would soon arrive. On August 25, 1904, the California Supreme Court ruled in Susanville v Zimmerman, et al that the town’s saloon owners had to pay the license fees to the City.